How To Record Term Loan In Accounting . *assuming that the money was deposited directly in the firm’s bank. While running your business, you might need a loan to purchase. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. following is the journal entry for loan taken from a bank; firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. learn how to record a loan for an asset in quickbooks online. the first step in recording a loan from a company officer or owner is to set up a liability account for the loan.

from www.wizxpert.com

the first step in recording a loan from a company officer or owner is to set up a liability account for the loan. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. While running your business, you might need a loan to purchase. firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. learn how to record a loan for an asset in quickbooks online. following is the journal entry for loan taken from a bank; *assuming that the money was deposited directly in the firm’s bank.

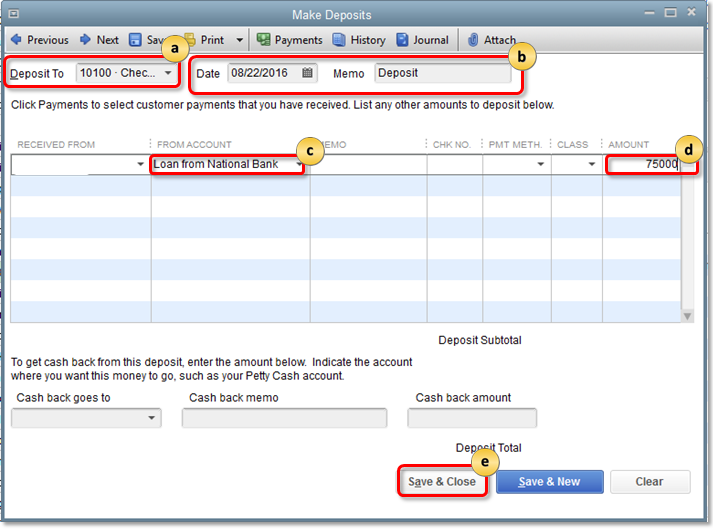

Learn How to Record Loan in QuickBooks in Easy Methods

How To Record Term Loan In Accounting recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. following is the journal entry for loan taken from a bank; recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. the first step in recording a loan from a company officer or owner is to set up a liability account for the loan. *assuming that the money was deposited directly in the firm’s bank. learn how to record a loan for an asset in quickbooks online. firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. While running your business, you might need a loan to purchase.

From quickbookexperts.blogspot.com

Learn how to set up accounts for your loans, and manually track them in How To Record Term Loan In Accounting the first step in recording a loan from a company officer or owner is to set up a liability account for the loan. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. *assuming that the money was deposited directly in the firm’s bank. . How To Record Term Loan In Accounting.

From mortgage-actually04.blogspot.com

Mortgage Payable Journal Entry How To Record Term Loan In Accounting *assuming that the money was deposited directly in the firm’s bank. While running your business, you might need a loan to purchase. firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. a loan payment is the amount of money that must be paid. How To Record Term Loan In Accounting.

From ar.inspiredpencil.com

Sample Accrual Schedule How To Record Term Loan In Accounting While running your business, you might need a loan to purchase. following is the journal entry for loan taken from a bank; *assuming that the money was deposited directly in the firm’s bank. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. . How To Record Term Loan In Accounting.

From exocrowqj.blob.core.windows.net

Accounting Journal Entry Terms at Kerry Cruz blog How To Record Term Loan In Accounting While running your business, you might need a loan to purchase. *assuming that the money was deposited directly in the firm’s bank. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. learn how to record a loan for an asset in quickbooks online. . How To Record Term Loan In Accounting.

From www.wizxpert.com

Learn How to Record Loan in QuickBooks in Easy Methods How To Record Term Loan In Accounting firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. the first step in recording a loan from a company officer or owner is to set up a liability account for the loan. following is the journal entry for loan taken from a. How To Record Term Loan In Accounting.

From ddrcqplfeco.blob.core.windows.net

How To Record Accounting Fees at Joel Keesler blog How To Record Term Loan In Accounting *assuming that the money was deposited directly in the firm’s bank. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. following is the journal entry for loan taken from a bank; learn how to record a loan for an asset in quickbooks. How To Record Term Loan In Accounting.

From www.pinterest.com

How to record Unsecured Loan receipt entry in Tally.ERP 9? Whatever we How To Record Term Loan In Accounting learn how to record a loan for an asset in quickbooks online. following is the journal entry for loan taken from a bank; While running your business, you might need a loan to purchase. *assuming that the money was deposited directly in the firm’s bank. the first step in recording a loan from a company officer or. How To Record Term Loan In Accounting.

From www.patriotsoftware.com

How to Record Accrued Interest Calculations & Examples How To Record Term Loan In Accounting a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. *assuming that the money was deposited directly in the firm’s. How To Record Term Loan In Accounting.

From ordnur.com

How to Make Loan Amortization Schedule in Excel ORDNUR How To Record Term Loan In Accounting following is the journal entry for loan taken from a bank; a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return. How To Record Term Loan In Accounting.

From www.youtube.com

How to Record A Payment To A Loan In QuickBooks Online YouTube How To Record Term Loan In Accounting firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. learn how to record a loan for an asset in quickbooks online. the first step in recording a loan from a company officer or owner is to set up a liability account for. How To Record Term Loan In Accounting.

From www.youtube.com

Accounting for Loan Receivable (Part 1) YouTube How To Record Term Loan In Accounting While running your business, you might need a loan to purchase. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment.. How To Record Term Loan In Accounting.

From www.cfajournal.org

How to Record Loan Received Journal Entry? (Explanation and More How To Record Term Loan In Accounting *assuming that the money was deposited directly in the firm’s bank. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. following is the journal entry for loan taken from a bank; firstly the debit to the interest expense records the accounting entry. How To Record Term Loan In Accounting.

From www.youtube.com

QuickBooks Online How to Record a Loan Payment YouTube How To Record Term Loan In Accounting a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. learn how to record a loan for an asset in quickbooks online. following is the journal entry for loan taken from a bank; the first step in recording a loan from a. How To Record Term Loan In Accounting.

From www.youtube.com

How to Record Loan Payments in Quickbooks Online YouTube How To Record Term Loan In Accounting following is the journal entry for loan taken from a bank; firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. While running your business, you might need a loan to purchase. the first step in recording a loan from a company officer. How To Record Term Loan In Accounting.

From www.wizxpert.com

Learn How to Record Loan in QuickBooks in Easy Methods How To Record Term Loan In Accounting the first step in recording a loan from a company officer or owner is to set up a liability account for the loan. recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. a loan payment is the amount of money that must be. How To Record Term Loan In Accounting.

From exomjmvwf.blob.core.windows.net

What Is A Journal Entry In Finance at Jennifer Bernier blog How To Record Term Loan In Accounting recording a loan in bookkeeping often involves reporting the receipt of the loan, paying for interest expense over time and the return of. the first step in recording a loan from a company officer or owner is to set up a liability account for the loan. learn how to record a loan for an asset in quickbooks. How To Record Term Loan In Accounting.

From www.profitbooks.net

Advanced Accounting Using Journal Entry How To Record Term Loan In Accounting firstly the debit to the interest expense records the accounting entry for interest on the loan for the year calculated at 6% on the. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. the first step in recording a loan from a. How To Record Term Loan In Accounting.

From sahids.com

How To Book A Loan In Accounting SAHIDS How To Record Term Loan In Accounting following is the journal entry for loan taken from a bank; learn how to record a loan for an asset in quickbooks online. a loan payment is the amount of money that must be paid to a lender at regular intervals in order to satisfy the repayment. recording a loan in bookkeeping often involves reporting the. How To Record Term Loan In Accounting.